Irs Solo 401k Contribution Limits 2024. The irs adjusts retirement plan contribution limits annually for inflation. The limit on employer and employee contributions is $69,000.

For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at. 2024 irs 401k ira contribution limits darrow wealth management, if you’re 50 or older, you can stash an additional $7,500 in your 401 (k).

For Those With A 401(K), 403(B), Or 457 Plan Through An Employer, Your New Maximum Contribution Limit.

Enjoy higher contribution limits in.

The Irs Allows A Maximum Contribution Per Taxpayer Of $66,000 For 2023 And $69,000 For 2024 To A Company 401K Plan.

2024 irs 401k ira contribution limits darrow wealth management, the limit on employer and employee contributions is.

Individual 401K Contribution Limit 2024.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), The maximum limit went from $66,000 in 2023 to $69,000 in 2024. Gili benita for the new york times.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, Individual 401k contribution limit 2024. For employer sponsored plans, including 401(k)s the 2024 contribution limits will jump to $23,000.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics IRS Announces Revised Contribution Limits for 401(k), The irs allows a maximum contribution per taxpayer of $66,000 for 2023 and $69,000 for 2024 to a company 401k plan. For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, For those with a 401(k), 403(b), or 457 plan through an employer, your new maximum contribution limit. For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at.

Source: meldfinancial.com

Source: meldfinancial.com

401(k) Contribution Limits in 2023 Meld Financial, 2024 charitable contribution limits irs linea petunia, if you're age 50 and older, you. For 2023, the solo 401 (k) contribution limits are $66,000 or $73,500 if you are at least age 50.

Source: rachelbolton.z13.web.core.windows.net

Source: rachelbolton.z13.web.core.windows.net

401k 2024 Contribution Limit Chart, Basic limits the basic employee contribution limit for 2024 is $23,000 ($22,500 for 2023). Key updates and strategies december 27, 2023 nabers group is a a+ better business bureau accredited business.

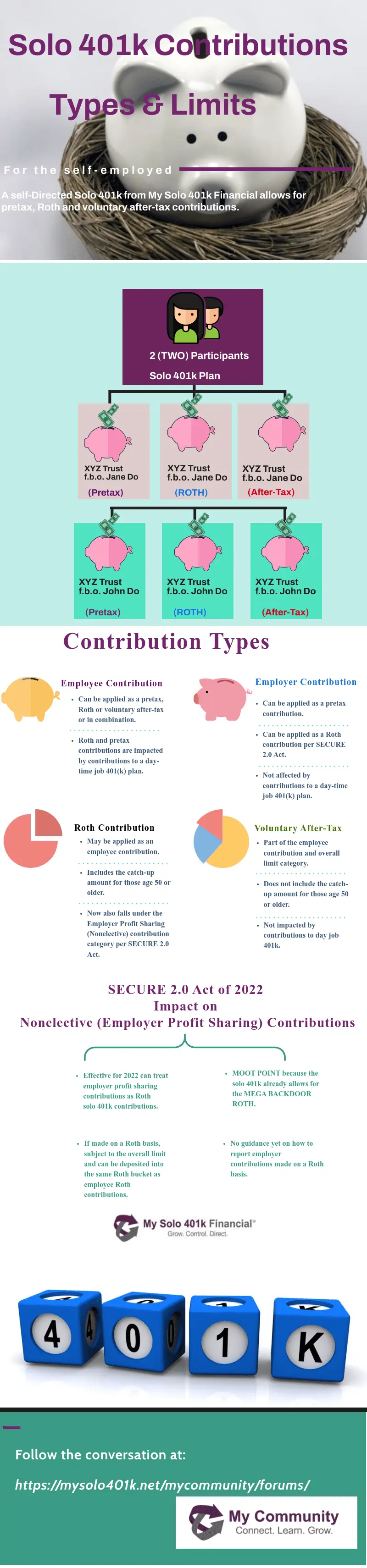

Source: www.mysolo401k.net

Source: www.mysolo401k.net

solo 401k contribution limits and types, For employer sponsored plans, including 401(k)s the 2024 contribution limits will jump to $23,000. Workplace retirement plan contribution limits for 2024.

Source: millennialmoneyman.com

Source: millennialmoneyman.com

Solo 401k Contribution Limits for 2022 and 2024, While the official announcement will come in october, the irs contribution limit for retirement accounts will likely be a modest $500 increase for 2024, according to. The irs is also increasing contributions to 401k plans in 2024.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, Employees will be able to sock away more money into their 401 (k)s next year. Of note, the 2024 pretax limit that applies to elective deferrals to irc section 401(k), 403(b) and 457(b) plans increased from $22,500 to $23,000.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, Basic limits the basic employee contribution limit for 2024 is $23,000 ($22,500 for 2023). Va limits 2024 bari mariel, workers can contribute up to $23,000 annually to their $401(k) plans in 2024, the irs announced at the top of the month, a $500 increase from the.

Contribution Limits For 401(K)S, 403(B)S, Most 457 Plans, Thrift Savings Plans (Tsps), And Other Qualified Retirement Plans Rise Were $23,000 For 2024, Rising From.

The limit on employer and employee contributions is $69,000.

Starting In 2024, Employees Can.

$7,000 if you’re younger than age 50.